Property Tax Breaks For Seniors In Md . in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and. the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the renters’ property tax credit program similarly provides tax relief for eligible renters who pay high monthly.

from www.formsbank.com

the renters’ property tax credit program similarly provides tax relief for eligible renters who pay high monthly. the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and.

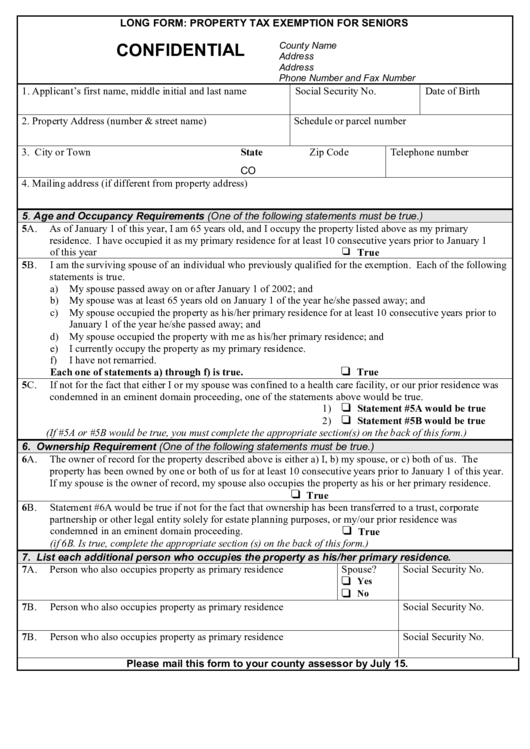

Long Form Property Tax Exemption For Seniors printable pdf download

Property Tax Breaks For Seniors In Md the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. the renters’ property tax credit program similarly provides tax relief for eligible renters who pay high monthly. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and. the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see.

From theconsumerhq.com

Property Tax Relief For Seniors The Consumer HQ Property Tax Breaks For Seniors In Md the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the renters’ property tax credit program similarly provides tax relief for eligible renters who pay. Property Tax Breaks For Seniors In Md.

From www.abc.net.au

Why special tax breaks for seniors should go ABC News Property Tax Breaks For Seniors In Md the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years. Property Tax Breaks For Seniors In Md.

From greatsenioryears.com

Maryland Property Tax Breaks for Seniors Greatsenioryears Property Tax Breaks For Seniors In Md in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. in april 2006, the carroll county board of commissioners voted to. Property Tax Breaks For Seniors In Md.

From greatsenioryears.com

Maryland Property Tax Breaks for Seniors Greatsenioryears Property Tax Breaks For Seniors In Md the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. the state of maryland has developed a program which allows credits against the homeown. Property Tax Breaks For Seniors In Md.

From danielsgonzales.com

Tax breaks for seniors and low/fixed taxpayers in California Property Tax Breaks For Seniors In Md the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. the renters’ property tax credit program similarly provides tax relief for eligible renters who pay. Property Tax Breaks For Seniors In Md.

From happierathome.com

Top Tax Breaks for Seniors Happier at Home Property Tax Breaks For Seniors In Md in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and. the renters’ property tax credit program similarly provides tax. Property Tax Breaks For Seniors In Md.

From repstevenreick.com

Providing Some Property Tax Relief for Seniors Steve Reick Property Tax Breaks For Seniors In Md the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the state of maryland developed a program which allows credits against the homeowner's property tax. Property Tax Breaks For Seniors In Md.

From greatsenioryears.com

Maryland Property Tax Breaks for Seniors Greatsenioryears Property Tax Breaks For Seniors In Md the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and. the renters’ property tax credit program similarly provides tax relief for eligible renters who pay. Property Tax Breaks For Seniors In Md.

From www.shorelineareanews.com

Shoreline Area News Property tax exemption for seniors Property Tax Breaks For Seniors In Md the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the renters’ property tax credit program similarly provides tax relief for eligible renters who pay high monthly.. Property Tax Breaks For Seniors In Md.

From www.austinmonitor.com

Austin approves additional property tax breaks for seniors and people Property Tax Breaks For Seniors In Md the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the state of maryland has developed a program which allows credits against the homeown. Property Tax Breaks For Seniors In Md.

From www.deeds.com

Property Tax Breaks for Older Homeowners (New Changes for NJ, PA, and Property Tax Breaks For Seniors In Md the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. in april 2006, the carroll county board of commissioners voted to ease. Property Tax Breaks For Seniors In Md.

From www.seniorassistance.club

The Real Truth About Property Tax Break for Senior Citizens Property Tax Breaks For Seniors In Md the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the. in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. the state of maryland developed a program which allows credits against. Property Tax Breaks For Seniors In Md.

From www.syracuse.com

Onondaga County lawmakers expand property tax breaks for seniors Property Tax Breaks For Seniors In Md the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. the senior tax credit is available to homeowners at least 65 for. Property Tax Breaks For Seniors In Md.

From www.syracuse.com

Onondaga County lawmakers expand property tax breaks for seniors Property Tax Breaks For Seniors In Md the state of maryland developed a program which allows credits against the homeowner's property tax bill if the property taxes exceed a fixed. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and. in maryland, property tax breaks for seniors are available to homeowners who. Property Tax Breaks For Seniors In Md.

From www.propertyrebate.net

Property Tax Rebate Form For Seniors In Pa Printable Rebate Form Property Tax Breaks For Seniors In Md the renters’ property tax credit program similarly provides tax relief for eligible renters who pay high monthly. the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. the state of maryland has developed a program which allows credits against the homeown er's property tax bill if the.. Property Tax Breaks For Seniors In Md.

From greatsenioryears.com

Maryland Property Tax Breaks for Seniors Greatsenioryears Property Tax Breaks For Seniors In Md the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. in april 2006, the carroll county board of commissioners. Property Tax Breaks For Seniors In Md.

From greatsenioryears.com

Florida Property Tax Breaks for Seniors Explained Greatsenioryears Property Tax Breaks For Seniors In Md the senior tax credit is available to homeowners at least 65 for whom the property is their principal residence (see. in maryland, property tax breaks for seniors are available to homeowners who are at least 65 years old and have lived in their homes for a. in april 2006, the carroll county board of commissioners voted to. Property Tax Breaks For Seniors In Md.

From qns.com

‘Still Your City’ Mayor talks property tax breaks for seniors in Glen Property Tax Breaks For Seniors In Md the state of maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the. in april 2006, the carroll county board of commissioners voted to ease the tax burden on carroll’s senior residents age 65 and. the state of maryland developed a program which allows credits against the homeowner's. Property Tax Breaks For Seniors In Md.